10 Ways to Improve Your Personal Finances

Personal Finances and financial management can be understood as the process of planning, organizing, and monitoring your financial resources. It entails making informed decisions about how to utilize money to achieve financial goals effectively.

If you want to know some important ways to keep your finances in order and improve your financial management, keep reading!

Everyone’s financial situation is different, and so is every person, but some specific methods or strategies can help you enhance your financial management skills. Let’s begin!

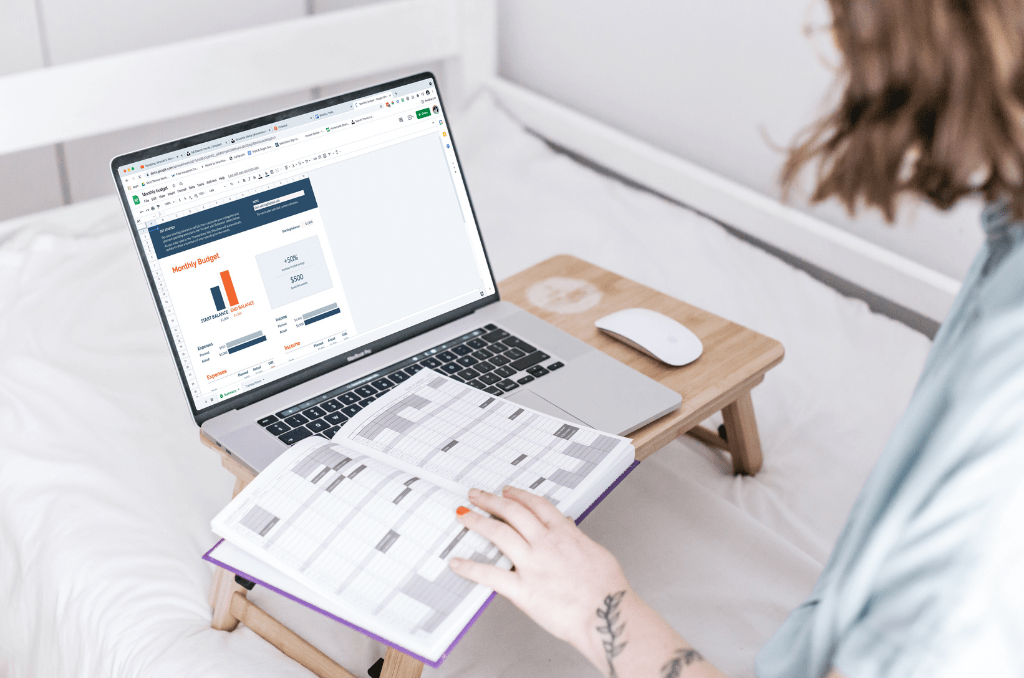

1- Understand your situation with a Budget

First, track your income and expenses to understand your financial situation. To do this, determine your total monthly income, including all sources of income.

Then, allocate it to various categories such as housing, groceries, savings, debt payments, and so on. This will give you an accurate understanding of where your money is going.

Stick to your budget to manage your expenses effectively!

2- Minimize expenses

Review your expenses and identify which areas you can diminish. Seek to save money!

Identify discretionary expenses that you can reduce or eliminate, such as eating out less frequently, choosing other options for entertainment, or finding more affordable alternatives for hobbies, products, or services.

More ways to reduce expenses could be:

-Negotiating bills and asking for better rates or discounts.

-Planning your meals, creating a shopping list, and sticking to it to avoid impulsive purchases.

-Looking for sales, using coupons, and considering buying generic or store brands to save money on groceries.

-Practicing mindful spending. Before making a purchase, take a moment to consider if it aligns with your needs and priorities.

3- Increase Income or create a Passive One

Explore opportunities to increase your income, such as asking for a raise at work, taking on a side or part-time job, or starting a small business or freelancing.

Also, creating a passive income stream can provide you with additional financial stability and flexibility.

Selling Digital products and services is a great option if you have the knowledge or expertise to do it!

These products or services require an initial investment of time, money, or effort but the good news is that can generate passive

income as they can be sold repeatedly without additional work.

4- Set Financial Goals

This is an important step to achieve financial success.

Determine the specific aspects of your financial management that need improvement. This could include

budgeting, saving, debt management, investment strategies, expense control, or increasing income.

Determine your short-term and long-term financial goals. Whether it’s paying off debt, saving for a down payment, or investing for retirement, having clear goals will help you stay focused and motivated.

Rank your financial management goals based on their importance and urgency, depending on the stage of your life

and the situation you find yourself in.

Prioritizing goals helps you allocate resources, time, and effort effectively.

5- Build an Emergency Fund

An Emergency Fund is a dedicated savings account or fund specifically set aside to cover unexpected expenses or financial emergencies.

It helps you handle unforeseen circumstances, such as medical emergencies, car repairs, job loss, or major home repairs, without resorting to high-interest debt or derailing your financial goals.

Aim to save three to six months’ worth of living expenses to provide a financial safety net and have a sense of financial

security and stability!

6- Manage Debt

Start by understanding the full extent of your debt. Make a list of all your debts, including credit cards, loans, and other outstanding balances. Write everything down! understand clearly interest rates and minimum payments, and also due dates for each debt. You can use a spreadsheet or a table to help you see the information more clearly.

Next, develop a strategy to tackle your debt. Prioritize high-interest debts and consider consolidation or refinancing options to lower interest rates and make payments more manageable.

7- Educate Yourself

Learning about financial management is a valuable skill that can greatly benefit your personal and professional life.

Take the time to do it!

Read books, attend workshops, or follow reputable financial blogs to improve your financial literacy and make informed decisions.

These are some popular books that can help you improve your financial Knowledge:

–The Total Money Makeover by Dave Ramsey

–Rich Dad Poor Dad by Robert Kiyosaki

–I Will Teach You to Be Rich by Ramit Sethi.

Also, seek guidance from professionals in the field or people who can help you maintain your learning to improve your

financial management, such as our coaches.

8- Learn to Automate

Automating savings and bill payments can help simplify your financial management and ensure that you stay on track with your financial goals!

Set up automatic transfers to a savings account and automate bill payments to ensure you save regularly and avoid late fees.

Also, learn to use online banking tools and take advantage of these tools’ benefits. Many banks offer features allowing you to schedule recurring payments, set savings goals, and track your expenses. Explore these features and utilize them to streamline your financial management.

9- Review Insurance Coverage

Review your insurance policies, including auto, home, renters, health, life, and disability insurance.

Understand the specifics of each policy, such as coverage limits, deductibles, and premiums.

Next, evaluate your needs. Consider your current life circumstances and financial goals to determine if your existing coverage adequately meets your needs.

10- Regularly Review

Keep track of your progress and regularly review your financial situation. Make adjustments to your budget, goals, and strategies as needed.

Extra tip: Maintain the appropriate Mentality!

There are plentiful opportunities, resources, and possibilities available in the world! So approach this process and life with a positive Outlook.

A Positive Mindset will help you to view setbacks or challenges as temporary and solvable, rather than insurmountable obstacles. Read more about this HERE.

Get help to gain a deeper understanding of financial management skills and support in this process: Book a Free Life Coaching Session Today with our certified life coaches, and learn how to achieve financial freedom and success!